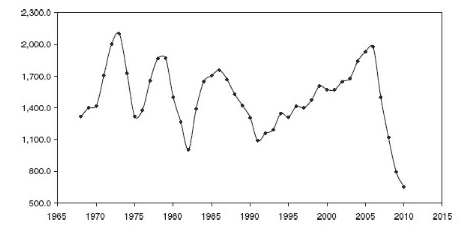

Real estate market cycles includes four phases: recovery, expansion, hyper supply, recession. Recovery is the phase following a great recession where occupancies and rent are low and construction slows and gradually strengthens and goes high. Expansion is the phase when the market is fully recovered and the market is strong. Vacancies are low, rents are high, stock prices are high, and new construction is ongoing. Here is the phase where investors buy or renovate properties. Hyper supply is the phase where supply catches up to high demand and vacancies start to increase and prices to drop. Here, investors buy when others are nervous about the coming phase of the recession, then to wait for recovery to sell. Recession is the phase witness oversupply of stock, fast rent drop, high vacancy rates. In this phase, the rent growth below the inflation rate. These phases take place in a cycle of time length of 10-15 years see figure 1.

Figure 1 Building cycles in the USA, 1968–2010: new privately owned housing units completed (in thousands). (Nicholas, 2013)

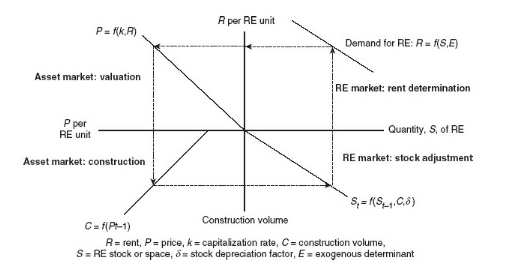

Dipasquale- Wheaton conducted several studies on the market cycle and the relationship between three major components: real estate, capital market, construction. The DiPW model is represented in the four Cartesian coordinates see figure 2.

Figure 2. The DiPW model presented in the Cartesian coordinates

The four parts of this model presents equilibrium in the real estate market. RE market, Asset market, Construction, and stock change values are produced from the four relevant functions presented in the figure 2. Any change in one of the four components cause change in the others until the market reaches the balance state presented in the dotted rectangle.

The two researches who invented this model based their invention on studies of the USA commercial and residential market of previous periods ranging from the late sixties to mid-nineties. The four components in this model hold a different relationship. An increase or decrease in demand causes a same effect in the other components. When asset market value changes, it holds inverse relation with rent, but positive relation with other components. An increase or decrease in construction has a positive effect on stock, but inverse effect on price and rent. The only component in this model that holds a positive relationship with all other components is the demand.

Investment decisions in real estate relay on the available accurate real estate market forecast. Many factors are studied by market researchers in this process as income, population growth, employment, borrowing capacity, and credit availability. My article is concerned mainly about the major component of the market cycle the Demand, which have the positive effect on all other major components. The scenarios illustrated here may happen when a crisis hit the economy.

These scenarios happened when the 2008 crisis hit the Middle East market and caused great damage to the real estate sector that is suffering till this date. In 2008, as it is called in economic terms, a bubble. A huge amount of real estate stock was available and the construction activity in some percentage was forced to continue. A drop in real estate property prices and rents that continued to 2015 and gained limited recovery these days. In order to solve the market problem in this condition, there are three scenarios that could introduce a positive effect on demand to make it grow up.

Scenario 1

In the oversupply state of 2008, many investors withdraw from completing their projects, others stopped the construction, and others sold the property in its state of construction. When property price is declining, this causes some investors to buy and wait for recovery to use the building or sell. Here I am looking in the state of oversupply and what might drive demand to grow?

When an owner has already completed his property construction before the crisis hit and its on lease for some time. He here obtained a certain amount of revenue from rent. If the property price declined by a certain percentage and the amount of revenue, he obtained covers the property construction cost of its completion date. The owner will think of selling his property to catch money and to protect his capital as prices are declining more and more.

Scenario 2

As the crisis hits, the economy and property are oversupplied. The construction sector, building material, relevant trade sectors will halt and activities will witness a big decrease. If oversupply of property stock exists and rents are declining the development in construction sector will divert to manufacturing high technology and services rather than commercial and residential. On this occasion, certain jobs will be in demand and cause related sector employment to grow. Any related shift in working force caused by this demand will make a demand for rental space, whether it’s commercial or residential. An increase in high-tech industry sector and services, whether it is public sector or private sector will drive relevant supporting business to grow. That will have an extra demand on residential space rent.

Scenario 3

In my previous article, I have discussed the importance of land ownership on the development and construction status. Many investors decide to develop on leased land for a certain period, for example 25 years. Adding to that go into the private sector full or partial funding for the development. In the Middle East, the lease agreement obligates the investor to hand over the development after the lease period to the landowner. Here and in order to create demand for property sale and rent the private sector or public sector owner will think to increase the lease period to double or triple, or give the land as freehold for the investor which is a very effective solution to move demand for sale of commercial and residential buildings.

[…] That way cities flourish because of many sectors that provide a place for inhabitance and move the economic cycle and business cycle in the […]

[…] like to read about the market cycle and its influence on creating jobs, you can read my article click here. […]

[…] In the two examples of papers and organization publication the rotation of the same principles and supporting and enabling conditions. Organizations hold international conferences worldwide and a country in the Middle East appears active participants and shows willingness to develop and achieve but the reality is different. Issuing a permanent residency when buying a property worth 330,000 $ 330,000 leads to nothing. Providing golden visas for people having the same rules as EU, and USA countries but with no legal rights. Giving foreigners the Passport but not specifying what are the roots, paths, and methods to achieve that is not logical. Now, why I should come to this country to get a permanent residency or golden visa or passport if the country is suffering from economic decline, economic activities and construction are declining, and the country is relying on foreign workers? Why should I stay in the country if there is nothing to do? These economic and policy changes in a country that does not have a constitution will not boost urban development. There is no relation to the strategies and methods to move the real estate or economic cycle in a country. […]

[…] of urban development projects, and architectural projects. Funds play a major role in moving the real estate cycle and related business cycles. It also affects the implementation of many public bodies and private […]

[…] and architecture, the consortium has overcome the main two elements and barriers to development Land ownership, and […]